montana sales tax rate 2019

This rate includes any state county city and local sales taxes. While Montana has no statewide sales tax some municipalities and cities especially large tourist destinations charge their own local sales taxes on most purchases.

Sales Taxes In The United States Wikiwand

Oregons limit is 6500 Excludes Washingtons BO tax Page 3.

. There are a total of 73 local tax jurisdictions across the state collecting an average local tax of 0002. Sales tax region name. Tax Foundation Facts and Figures 2019 - Table 12 for 2019 2.

11100 4 of taxable. 1 A sales tax of the following percentages is imposed on sales of the following property or services. Imposition and rate of sales tax and use tax -- exceptions.

Montana is ranked number twenty nine out of the fifty states in order of the average amount of property taxes collected. By Justin Fontaine July 26 2019. Montana Code Annotated 2019.

If your taxable income Form 2 page 1 line 14 is. 3100 1 of taxable income. Tax rates last updated in February 2022.

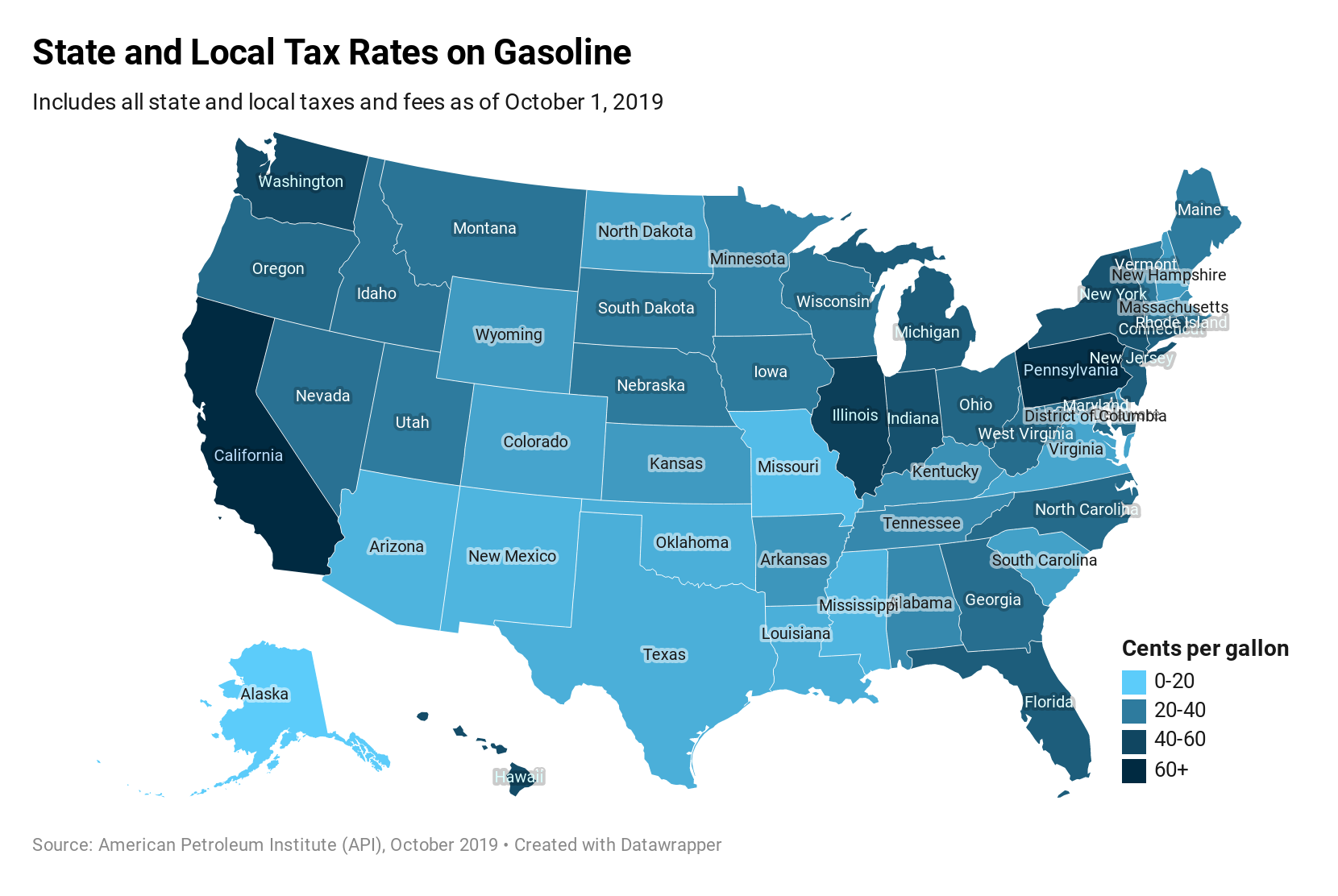

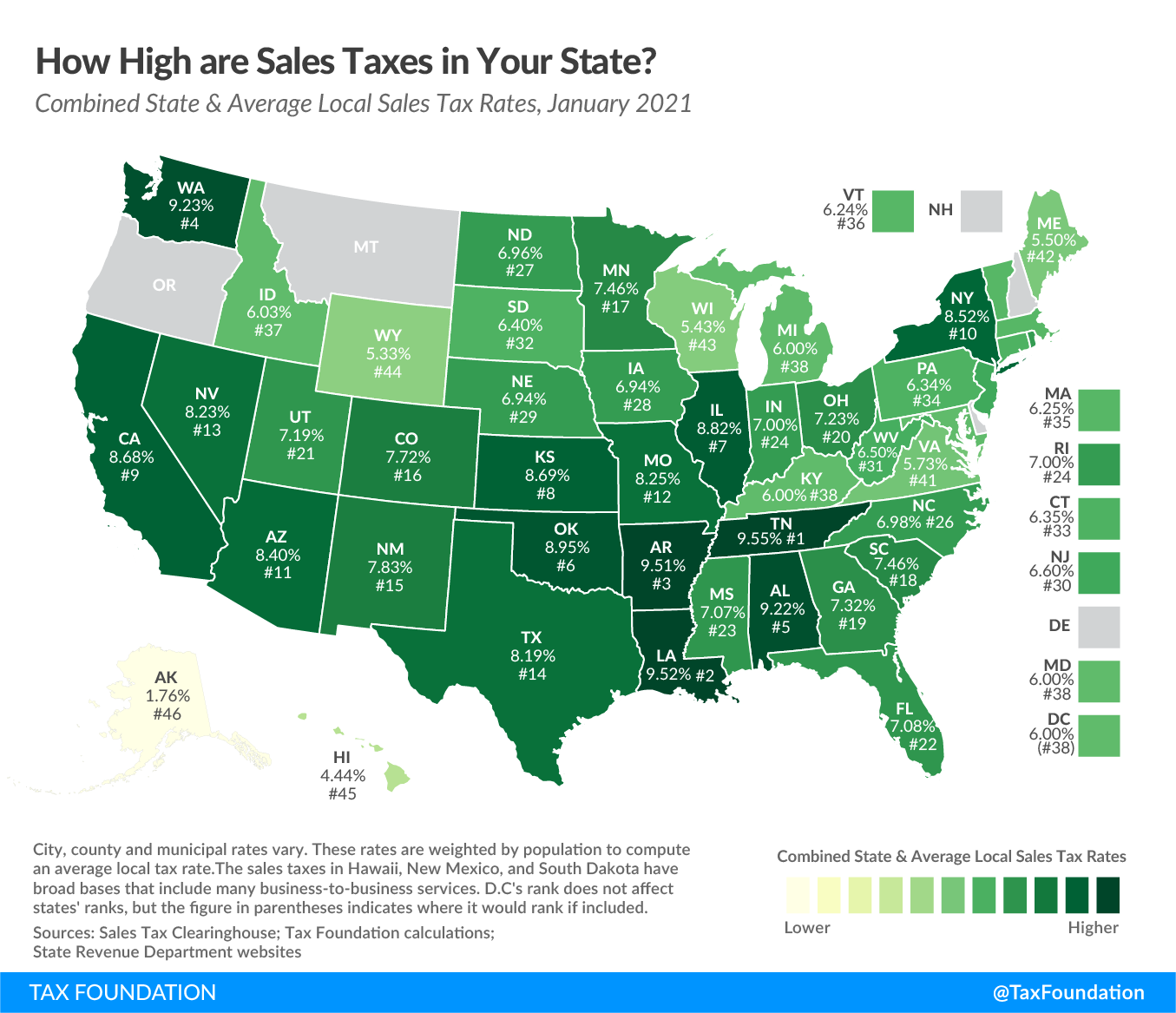

Tax rate of 2 on taxable income between 3101 and 5400. The five states with the highest average local sales tax rates are Alabama 522 percent Louisiana 507 percent Colorado 475 percent New York 452 percent and Oklahoma 445 percent. There are no local taxes beyond the state rate.

This is the total of state county and city sales tax rates. Montana new employer rate. 2019 Montana Individual Income Tax Rates.

Sales tax rate differentials can induce consumers to shop across borders or buy products online. Montana needs to fully overhaul the tax structure and if that involves a sales tax higher income tax a summer tourist tax or legalizing marijuana so be it. Your free and reliable 2019 Montana payroll and historical tax resource.

013 to 630 for 2019. 2019 Montana Tax Tables with 2022 Federal income tax rates medicare rate FICA and supporting tax and withholdings calculator. The minimum combined 2021 sales tax rate for Mountain View California is.

Montana limits the amount of Federal taxes which can be deducted to 10000 for a mar- ried couple filingjointly and 5000 for individuals. The County sales tax rate is. 2020 rates included for use while preparing your income tax deduction.

The Mountain View sales tax rate. Counties in Montana collect an average of 083 of a propertys assesed fair market value as property tax per year. In 2020 Montana ranked 26th in 2019 Montana ranked 25th in 2016 Montana ranked 24th in 2014 Montana was ranked 15th among states taxing at the individual level and in 2005 Montana was ranked 26th.

For married taxpayers living and working in the state of Montana. The cities and counties in Montana also do not charge sales tax on general purchases so. The California sales tax rate is currently.

Sales tax rates differ by state but sales tax bases also impact how much revenue is collected from a tax and how the tax affects the economy. The Department of Revenue works hard to ensure we process everyones return as securely and quickly as possible. Tax rate of 69 on taxable income over 18400.

8200 3 of taxable income. Tax rate of 6 on taxable income between 14301 and 18400. 2020 Montana Individual Income Tax Help Form.

Tax rate of 1 on the first 3100 of taxable income. Each marginal rate only applies to earnings within the applicable marginal tax bracket which are the same in. The bill excludes resort communities with more than 5500 people.

The only exclusion is Whitefish which has a population of about 7000. The median property tax in Montana is 146500 per year for a home worth the median value of 17630000. 5400 2 of taxable income.

Jeff Welborn R-Dillon said the town requested it be carved out of the legislation. Unfortunately it can take up to 90 days to issue your refund and we may need to ask you to verify your return. The Montana MT state sales tax rate is currently 0.

The Montana state sales tax rate is 0 and the average MT sales tax after local surtaxes is 0. The bills sponsor Sen. If you want to simplify payroll tax calculations you can download ezPaycheck payroll software which can calculate federal tax state tax Medicare tax Social Security Tax and other taxes for you automatically.

Only nine of the ten resort communities in Montana could increase their tax under SB 241. 2021 Local Sales Tax Rates. Click here for a larger sales tax map or here for a sales tax table.

But not more than Then your tax rate is. Montana has seven marginal tax brackets ranging from 1 the lowest Montana tax bracket to 69 the highest Montana tax bracket. SALES TAX Part 1.

Imposition of Tax Imposition And Rate Of Sales Tax And Use Tax -- Exceptions 15-68-102. Your free and reliable 2019 Montana payroll and historical tax resource. The state sales tax rate in Montana is 0000.

No states saw ranking changes of more than one place since July. Compare your take home after tax and estimate your tax return online great for single filers married filing jointly head of household and widower. Calculate your state income tax step by step 6.

Montana charges no sales tax on purchases made in the state. The latest sales tax rate for Mount Airy NC. Montana is one of only five states without a general sales tax.

Montanas top rate 69 is levied when a persons income is beyond 14900. Montana Individual Income Tax Resources. Montana SUI Rates range from.

Its sales tax from 595 percent to 61 percent in April 2019. Montana Individual Income Tax. Check the 2019 Montana state tax rate and the rules to calculate state income tax 5.

Montana has no state sales tax and allows local governments to collect a local option sales tax of up to NA.

Salestaxhandbook The Comprehensive Sales Tax Guide

States Without Sales Tax Article

State Corporate Income Tax Rates And Brackets For 2022 Tax Foundation

How Do State And Local Sales Taxes Work Tax Policy Center

Sales Tax Definition What Is A Sales Tax Tax Edu

States Without Sales Tax Article

Montana State Taxes Tax Types In Montana Income Property Corporate

Beginner S Guide To Dropshipping Sales Tax Blog Printful

States With Highest And Lowest Sales Tax Rates

Montana State Taxes Tax Types In Montana Income Property Corporate

State Income Tax Rates And Brackets 2022 Tax Foundation

Ebay Sales Tax Everything You Need To Know Guide A2x For Amazon And Shopify Accounting Automated And Reconciled

2022 Sales Taxes State And Local Sales Tax Rates Tax Foundation

Montana State Taxes Tax Types In Montana Income Property Corporate